ARC vs PLC - overview

Sign-up period - NOW:

Deadline: March 15th, 2021

If you fail to sign-up by the deadline, you MAY NOT be eligible for a 2021 payment.

Sign up is done through your FSA office

ARC vs PLC - which one will be the better choice?

To save you a bunch of reading and scrolling, I decided to put my summary first. If you want more detail, prices, and examples, keep scrolling on down after reading the below summary.

Hopefully, neither one will pay!

Meaning hopefully we have great yields & prices.

Even if we have just average yields and prices, it looks like there will not be a payment on either corn or soybean base acres.

If we have below average yields but higher prices like we are seeing now, we could still have average or above revenue and have no payment under ARC or PLC.

Why choose ARC-CO?

If you are more concerned about low yields, or worse yet low yields and low prices, ARC-CO would be the way to go.

Why choose PLC?

If you are more concerned about low prices and want price floors of $3.70 on corn and $8.40 on soybeans, then PLC would be your choice.

IRR (Irrigated) - If you have primarily IRR acres, you may decide to chose PLC because the chance of county wide low yields on IRR is not as likely.

If you have wheat base acres, PLC looks to be a good way to go.

Additional thoughts:

The nice thing about ARC-CO is it is revenue based, so if yields were to be less this year, then we could trigger a payment that way rather than relying on price alone which is the case under PLC.

With that said, ARC-CO may also not pay if the higher prices offset the lower yields (i.e. the revenue is still at or above the ARC-CO guarantee).

The ARC & PLC elections can be done by crop, so could choose PLC for corn and ARC-CO for soybeans, or vice versa. The decision can also be varied by FSA Farm Number (FSN). One reason you may choose to do that is based on IRR and NI acres for a particular FSN.

More Overview Info:

PLC - Price Loss Coverage

ARC - Agriculture Risk Coverage

ARC-CO - ARC County - yields and coverage are on a county by county basis, this was the most common choice under the 2014 FB (about 95% of farms in this area where signed up under ARC-CO).

ARC-IC - ARC Individual - there is an individual option as well, but not very commonly used

The decision you are making NOW is just for the 2021 Crop Year (CY).

The decision you made LAST winter was for the 2019 and 2020 CYs.

For the 2021 CY, actual yields and prices are still completely unknown. For corn and soybeans, the yields are for the crops that we will plant this spring, but the pricing period actually doesn’t start until this coming fall on Sep. 1st and then runs until Aug. 31st of 2022 - that is why any possible payments are always a year after the growing season.

The ARC vs PLC choice is now an annual election, so we will be making this decision again for the 2022 and 2023 CYs.

Base Acres

Payments for a given CY, if any, are based on a farm’s base acres listed at FSA, NOT your actual planted acres.

So you may have base acres for grain sorghum or wheat on some of your farms and could be eligible for payments on those crop, even if you currently plant only corn and soybeans.

Base acres are NOT being changed / updated at this time.

Timing of Payments:

Payments for a given CY, if any, are paid out the following fall, usually in October. So for instance, if any payment is due for the 2021 CY, it will not be paid until fall of 2022. The reason for the delay is to allow actual county yields and the MYA (marketing year average) prices to be finalized.

MYA Price - Marketing Year Average Price:

A price calculated by NASS that is represents the national average cash price received by producers during the 12-month marketing year.

The Corn & Soybeans 2021 CY MYA 12-month time period is from Sep. 1st, 2021 to Aug. 31st, 2022. These MYA Prices will then be published around the end of Sept. 2022.

The 2020-21 (2020 CY) projected (estimated) MYA price for each crop is shown below along with the prices from previous years. The 2020-21 projections are taken from the USDA WASDE (Supply & Demand) report published earlier this week.

ARC-CO - key points & changes

The ARC-CO program provides revenue loss coverage at the county level.

Since it is revenue based, the coverage is a function of both county yields and price.

When both decline, the possibility of a payment is greater.

A payment is triggered when the ARC-CO actual revenue falls below the ARC-CO revenue guarantee

The ARC-CO revenue guarantee = 86% x (ARC-CO benchmark revenue)

So there is effectively a ‘14% deductible’ - see below table for the “effective” ARC-CO price (in column B)

The table below shows the 2020 and 2021 ARC prices and what 86% of those prices are to look at a ‘price loss only’ scenario and to allow a comparison to PLC.

As you can see, given the low ARC-CO benchmark prices and our now higher grain prices, the chances of a ‘price only loss’ is low.

Election and coverage are based on the county where the farm is located, NOT on the admin county where you enroll.

Actual ARC-CO yields are based on data from the RMA (Risk Management Agency). RMA gets their yield data directly from the yields we report through your federal crop insurance - MPCI.

Benchmark yield & prices

History used lags 2 years from current year – so the 2021 benchmark yields & prices is based on 2015-2019 yields and prices

The Benchmark yield includes a Trend Adjustment (TA) similar to crop insurance which helps to raise up the yields and ultimately the guarantee.

Plug (minimum) yields that are used has been increased from 70% to 80% of county T-Yields.

ARC-CO payment rate = lesser of

(ARC-CO revenue guarantee) - (ARC-CO actual revenue)

10% of the ARC-CO benchmark revenue

For all of the ARC-CO payment calculation details, scroll to the bottom of this update.

The table below shows 2021 ARC-CO numbers for corn and soybeans for counties in our area. The key number is the revenue guarantee highlighted in yellow. (I know the numbers are small, so if you click on the table, it should enlarge it or allow you to zoom in. You may want to view this one on your computer.)

On the right side, I give an EXAMPLE scenario for 2021 IF we were to have drought and have the same yields as 2012 and IF the MYA prices were to drop down to the PLC price floors of $3.70 corn and $8.40 soybeans.

In this ‘WHAT IF’ scenario, given such low yields for NI (non-irrigated), it looks like all counties in our area would receive the MAX ARC-CO payment for NI acres only which is equal to 10% of the Benchmark Revenue, but NO payment on IRR acres.

PLC - key points & changes

PLC possible payments are dependent on price declines alone (NO yield component).

PLC Effective Reference Prices (ERPs) for corn and beans are unchanged for 2021. The are currently equal to their base Reference Prices below.

The base Reference Prices (minimums / floors) are:

For the 2022 CY, it looks like the ERPs will also remain the same.

However, for the 2023 CY, there is a chance, although very small, that the ERPs could increase if much higher prices persist for this year and the next (it essentially takes two years of higher prices because it is a 5 year Olympic average, meaning you through out the high and the low, and since there is a two year lag):

PLC only makes a payment IF the MYA Price drops BELOW the PLC ERP (Effective Reference Price)

SCO (Supplemental Coverage Option)

If you elect PLC, you have the option of purchasing Supplemental Coverage Option (SCO)

If you elect ARC, you can NOT purchase SCO.

SCO is area/county based coverage that covers from the “86% level” down to your crop insurance coverage level. So if you have 75% MPCI, SCO covers an 11% band from 86% down to 75%, but again on an area or county basis.

SCO begins to pay when county average revenue falls below 86% of its expected level.

SCO is elected and purchased as part of your crop insurance policy.

ARC-IC

Individual rather than county based

Similar to ARC-CO in structure and payment formulas, but it is based on your farms individual yields, rather than county yields.

ARC-IC is similar to whole farm revenue coverage, in that it combines all crops together to look at the revenue for the whole farm. As a result, if you choose ARC-IC, you must chose it for all crops on that farm number (FSN) - i.e. ARC-IC is elected by FSN, not by crop. ARC-IC also crosses county lines.

Most producers already have their own individual MPCI coverage which will do a better job of covering their own fields rather than relying on ARC-IC to do so.

PLC payment calculation details:

IF MYA price comes in LESS THAN the PLC reference price, then there is a payment:

PLC ERP = higher of:

base Reference Price - $3.70 Corn, $8.40 Soybeans

85% of the 5yr Olympic MYA price for the previous 5 crop years given a 2 year lag (so for 2021, it looks at the MYA prices for 2015-2019).

i.e. take out the high and low prices for last 5 yrs & discount by 15%

For the 2021 CY, the current 5yr Olympic MYA price x 85% is $2.98 corn and $7.61 beans.

The PLC ERP is capped at 115% of the Reference Prices = $4.26 corn and $9.66 beans.

In other words, the PLC reference prices can NOT increase by more than 15%.

YOUR FARM’S PAYMENT = (Reference Price - MYA price) x (your farm’s PLC yield) x (your farm’s base acres) x 85%

Max PLC payment rate is equal to the crops ERP (eff. reference price) minus it’s loan rate

Corn: $3.70 - $2.20 = $1.50 max PLC payment rate

Beans: $8.40 - $6.60 = $2.20 max PLC payment rate

ARC-CO payment calculation details:

The ARC-CO revenue guarantee = 86% x (ARC-CO benchmark revenue)

As stated above, there is effectively a ‘14% deductible’

ARC-CO benchmark revenue = (ARC-CO benchmark price) x (ARC-CO benchmark yield)

ARC-CO benchmark price = 5 yr. olympic (drop high and low) avg. of the 5 most recent annual benchmark prices

annual benchmark prices = higher of : effective reference price -OR- the respective MYA price

ARC-CO benchmark yield = 5 yr. olympic (drop high and low) avg. of previous ARC-CO county yields (2 year lag and now trend adjusted up as mentioned above, and each year is capped at )

ARC-CO actual revenue = (ARC-CO actual price) x (ARC-CO actual county yield)

2021 ARC-CO actual price = higher of : 2021-22 MYA price -OR- 2021 national avg. loan rate

ARC-CO actual county yield = actual average yield for the county based on RMA yields that are received through crop insurance production reporting (MPCI).

This was NEW for the 2019 CY. In the past, the county yield was based on NASS survey data.

ARC-CO payment rate = lesser of

(ARC-CO revenue guarantee) - (ARC-CO actual revenue)

10% of the ARC-CO benchmark revenue

YOUR FARM’S PAYMENT = (applicable payment rate) x (your farm’s base acres) x 85%

Links to other resources & sources used:

LINK - FSA website 1 for ARC & PLC

LINK - FSA website 2 for ARC & PLC program data and estimated payment rates

LINK - FSA 2021 PLC prices

LINK - FSA 2021 ARC-CO prices

LINK - FSA 2021 ARC-CO benchmark yields and guarantees by county

LINK - KSU AgManager.info Risk Management

LINK - KSU - ARC vs PLC comparison spreadsheet

LINK - University of Illinois - Choosing Between ARC-CO and PLC

LINK - WASDE - Supply & Demand report

ARC vs PLC - overview

NEW 2018 Farm Bill

First time to change your elections since the 2014 Farm Bill (FB).

Sign up is done at your FSA office.

Sign-up period - NOW:

Deadline: March 15th, 2020

The sign-up period started back on Oct. 7th, 2019

If you fail to sign-up by the deadline, you will NOT be eligible for a 2019 payment

ARC - Agriculture Risk Coverage

ARC-CO - ARC County - on a county basis, this was the most common choice under the 2014 FB (about 95% of farms in this area where signed up under ARC-CO).

ARC-IC - ARC Individual - there is an individual option as well, but not as common

PLC - Price Loss Coverage

The decision you are making NOW is for the 2019 and 2020 Crop Years (CY).

So for the 2019 CY (crop year), we have the benefit of knowing more about expected yields (relatively good) and a little bit about expected prices to help us make the best decision. The longer you wait to enroll, the more that will be known about both prices and yields for the 2019 CY, but time is quickly running out.

However, for the 2020 CY, yields and prices are still completely unknown.

After your initial election this winter, it will become an annual election starting in 2021 through 2023. So you could opt to have different elections for each of those three CYs. If no election is made, then the same coverage you previously had carries forward.

Decision is made by crop, so could choose PLC for corn and ARC-CO for soybeans, or vice versa. The decision can also be varied by FSA Farm Number (FSN).

Base Acres

Payments for a given CY, if any, are based on a farm’s base acres listed at FSA, NOT your actual planted acres.

So you may have base acres for grain sorghum or wheat on some of your farms and could be eligible for payments on those crop, even if you currently plant only corn and soybeans.

Base acres are NOT being changed / updated at this time.

Informational meetings:

FSA & UNL hosted several informational meetings across the state over the past several weeks. UNL farm bill expert Dr. Brad Lubben (LINK to his website) presented at many of them and did a great job helping us to better understand these programs and this decision.

Timing of Payments:

Payments for a given CY, if any, are paid out the following fall, usually in October. So for instance, if any payment is due for the 2019 CY, it will not be paid until fall of 2020. The reason for the delay is to allow actual county yields and the MYA (marketing year average) prices to be finalized.

MYA Price - Marketing Year Average Price:

A price calculated by NASS that is represents the national average cash price received by producers during the 12-month marketing year.

The Corn & Soybeans 2019 CY MYA 12-month time period is from Sep. 1st, 2019 to Aug. 31st, 2020. These MYA Prices will then be published around the end of Sept. 2020.

The 2019-20 projected (estimated) MYA price for each crop is shown blow along with the prices from previous years:

ARC-CO - key points & changes

The ARC-CO program provides revenue loss coverage at the county level.

ARC-CO possible payments are a function of both county yields and price.

When both decline, the possibility of a payment is greater.

The ARC-CO revenue guarantee = 86% x (ARC-CO benchmark revenue)

so there is effectively a ‘14% deductible’ - see below table for the “effective” ARC-CO price (in column B)

Election and coverage are based on the county where the farm is located, NOT on the admin county where you enroll.

Actual ARC-CO yields will now be based on data from the Risk Management Agency (RMA) rather than data from the National Agricultural Statistics Service (NASS).

RMA gets their yield data directly from federal crop insurance - MPCI.

Benchmark yield & prices

History used lags 2 years from current year – so the 2019 yield benchmark is based on 2013-2017 yields and prices

The Benchmark yield will now include a Trend Adjustment (TA) similar to crop insurance which will help raise up the yields and ultimately the guarantee.

Plug yields used has been increased from 70% to 80% of county T-Yield

Yield designation status under ARC-CO increases the number of counties from an “All” type designation to an irrigated / non-irrigated designation.

PLC - key points & changes

PLC possible payments are dependent on price declines alone (NO yield component).

PLC Effective Reference Prices (ERPs) for corn and beans are unchanged for 2019. The are currently equal to their base Reference Prices below.

The base Reference Prices (minimums / floors) are:

The ERPs could increase for the 2020 CY or following CYs based formula shown below, but it would seem unlikely that they will as it would take considerably higher prices.

PLC ERP = higher of:

base Reference Price

85% of the 5yr Olympic MYA price

i.e. take out the high and low prices for last 5 yrs & discount by 15%

The current 5yr Olympic MYA price x 85% is $3.02 corn and $8.19 beans.

The PLC ERP is capped at 115% of the Reference Prices = $4.26 corn and $9.66 beans.

In other words, the PLC prices can NOT increase by more than 15%.

PLC only makes a payment IF the MYA Price drops BELOW the PLC ERP (Effective Reference Price)

Starting with the 2020 CY, you will have a one-time option to update your PLC yields to effectively 81% of your average yields for 2013-2017 CYs.

In short, you take the simple average of your yields by crop by FSN for 2013-2017 x 90% x 90%.

The last time yields were updated at FSA was for the 2014 FB. At that time, the yields were based on 90% of your 2008-2012 average, so those yields were artificially low as well.

Only if your new yield is higher will you update, otherwise it will be left the same (i.e. yield can’t go down)

There are other factors involved like plug yields (75% of county avg. yield) for years when you had a low yield - i.e. below 75% of the county average.

When you have your appointment at FSA to sign up, bring a copy of your yield history (crop ins. 10yr APH document is probably the best source) and they will take that info and help you figure out if it makes sense to update your PLC yields. You are not required to bring in your actual production records, but may be asked to provide if audited.

The deadline to update your yields is later: Sept. 30th, 2020. However, ideally you will get it done at the same time you sign-up before March 15th.

SCO (Supplemental Coverage Option)

If you elect PLC, you have the option of purchasing Supplemental Coverage Option (SCO)

If you elect ARC, you can NOT purchase SCO.

SCO is area/county based coverage that covers from the “86% level” down to your crop insurance coverage level. So if you have 75% MPCI, SCO covers an 11% band from 86% down to 75%, but again on an area or county basis.

SCO begins to pay when county average revenue falls below 86% of its expected level.

SCO is elected and purchased as part of your crop insurance policy.

ARC-IC

Individual rather than county based

Similar to ARC-CO in structure and payment formulas, but it is based on your farms individual yields, rather than county yields.

ARC-IC is similar to whole farm revenue coverage, in that it combines all crops together to look at the revenue for the whole farm. As a result, if you choose ARC-IC, you must chose it for all crops on that farm number (FSN) - i.e. ARC-IC is elected by FSN, not by crop. ARC-IC also crosses county lines.

ARC-IC seems to be the best choice on farms that have experienced poor yields this past year - a common cause for many would be FLOODING.

If you have a FSN that was all prevented plant (PP) or had a really poor yield due to flooding or excess moisture or another cause this past year, you will want to consider signing up that farm for ARC-IC. Ask you FSA office when you go to sign up for more details.

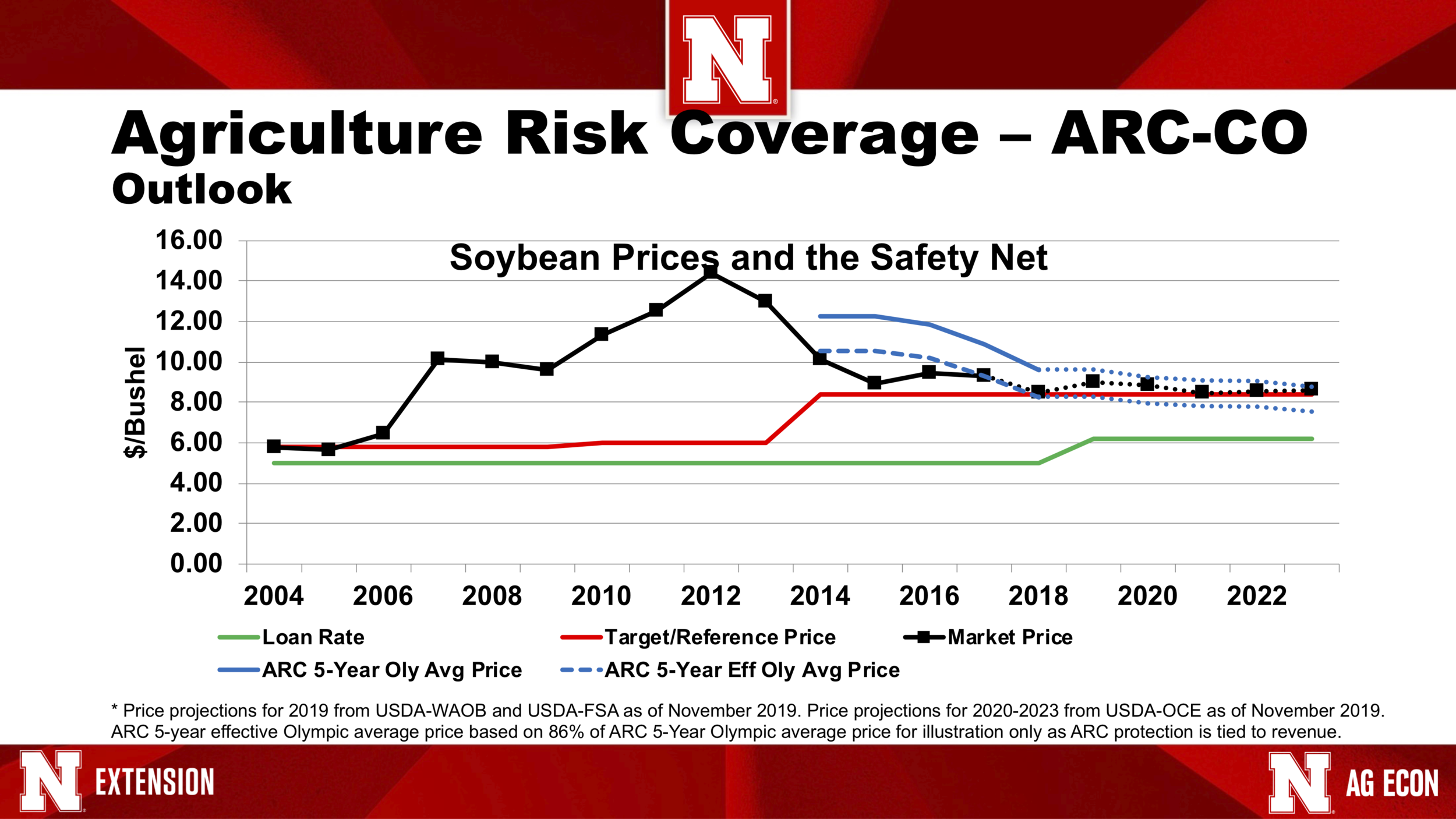

Price Charts - ARC vs PLC - by Dr. Brad Lubben, UNL Professor

Below are some great charts, one for Corn and one for Soybeans, that Dr. Brad Lubben put together that I think really help tell the story of where we have been and where we are now

I think these charts also point to why PLC might be a better choice than ARC-CO at this time.

ARC vs PLC - which one will be the better choice?

Initial predictions:

Neither will be as good as ARC was under the 2014 FB.

For corn, it seems PLC will be the better option for 2019, given the decent effective reference price of $3.70 and given the relatively good yields we had in our part of the state for 2019.

For soybeans, it seems to be more of a mixed bag. The key reference price for PLC is fairly low at $8.40. However, the ARC-CO ‘price only’ loss trigger point is not much lower at $8.28. The nice thing about ARC-CO is it is revenue based, so if yields were to be less next year, then we could trigger a payment that way rather than relying on price alone which is the case under PLC.

Given average to above average yields, ARC-CO is at a disadvantage to PLC b/c of the ‘14% deductible’ which eff. makes the price loss trigger point at $3.18 corn and $8.28 beans or lower - see above ‘ARC 2019’ table.

On the flip side, PLC is at a disadvantage to ARC-CO b/c it has NO yield component. So if we have a drought and prices stay the same or go higher, we may have a large yield loss, but receive no PLC payment. With that said, ARC-CO may also not pay if the higher price offsets the lower yield (i.e. the revenue is still at or above the ARC-CO guarantee).

If yields come in at or above average and prices stay about the same, it looks like the only possible payments will be for wheat and grain sorghum base acres. The payments look more likely under PLC but are also possible under ARC-CO. (see above ‘PLC 2019’ and ‘ARC 2019’ table for estimates).

IN SUMMARY:

It would seem to make sense to enroll in PLC for Corn, Wheat, and Grain Sorghum, at least for the 2019 CY (but again, you have to have the same election for 2020 as 2019).

For soybeans, the choice is not as clear. One may choose to go ARC-CO for beans just to diversify and to have the revenue / yield component on part of your acres.

Links to other resources & sources used:

LINK - KSU - ARC vs PLC comparison spreadsheet

LINK - KSU AgManager.info Risk Management

LINK - University of Illinois - Choosing Between ARC-CO and PLC

LINK - FSA 2019 PLC estimated payment rates

LINK - FSA 2019 ARC-CO estimated prices

LINK - FSA website 1 for ARC & PLC

LINK - FSA website 2 for ARC & PLC program data and estimated payment rates

LINK - WASDE - Secretary’s briefings on the WASDE report

LINK - WASDE - Supply & Demand report

LINK - Crop Progress - graphs by state of last 5 years

LINK - Crop Progress

Other Articles I read and pulled some of the above material from:

(1) AgWeb - ARC Versus PLC by Katie Humphreys, Mar 22, 2019 - LINK

(2) AgWeb - ARC or PLC - Which to Choose? by Paul Neiffer, Mar 14, 2019 - LINK

PLC payment calculation details:

IF MYA price comes in LESS THAN the PLC reference price, then there is a payment:

YOUR FARM’S PAYMENT = (Reference Price - MYA price) x (your farm’s PLC yield) x (your farm’s base acres) x 85%

Base acres are staying the same as previous, no changes with this election

Max PLC payment rate is equal to the crops ERP (eff. reference price) minus it’s loan rate

Corn: $3.70 - $2.20 = $1.50 max PLC payment rate

Beans: $8.40 - $6.60 = $2.20 max PLC payment rate

see ‘PLC 2019’ table above for numbers on wheat and grain sorghum

ARC-CO payment calculation details:

The ARC-CO revenue guarantee = 86% x (ARC-CO benchmark revenue)

As stated above, there is effectively a ‘14% deductible’

ARC-CO benchmark revenue = (ARC-CO benchmark price) x (ARC-CO benchmark yield)

ARC-CO benchmark price = 5 yr. olympic (drop high and low) avg. of the 5 most recent annual benchmark prices

annual benchmark prices = higher of : effective reference price -OR- the respective MYA price

ARC-CO benchmark yield = 5 yr. olympic (drop high and low) avg. of previous ARC-CO county yields (2 year lag and now trend adjusted up as mentioned above)

ARC-CO actual revenue = (ARC-CO actual price) x (ARC-CO actual county yield)

2019 ARC-CO actual price = higher of : 2019-20 MYA price -OR- 2019 national avg. loan rate

ARC-CO actual county yield = actual average yield for the county based on RMA yields that are received through crop insurance production reporting (MPCI).

This is NEW for 2019 CY. In the past, the county yield was based on NASS survey data.

ARC-CO payment rate = lesser of

(ARC-CO revenue guarantee) - (ARC-CO actual revenue)

10% of the ARC-CO benchmark revenue

YOUR FARM’S PAYMENT = (applicable payment rate) x (your farm’s base acres) x 85%

Base acres are staying the same as previous, no changes with this election